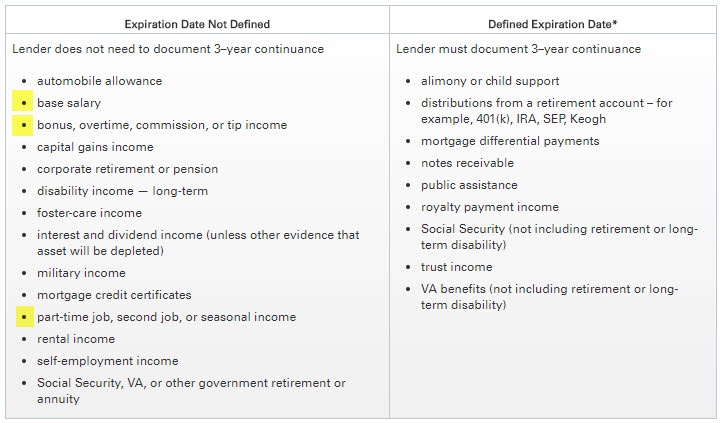

This means that lenders can through a process called grossing up add an additional 25 percent to your social security income because you won t be paying income tax on this income.

Can you get a mortgage if your only income is social security.

Once you begin receiving social security benefits this income can be used to qualify.

As an example if you earn 1 000 a month in social security your lender might count your social security income as 1 250 your 1 000 payment plus 25 percent.

Whether you are receiving retirement or disability benefits on your own behalf you will need.

The social security administrator s award letter and a proof of current receipt.

Understanding how the income can be used to qualify for a mortgage as well as the documents required to qualify will help you when applying.

The average social security benefit for a couple stands at a little north of 2 100 and banks seek to ensure that a mortgage is no more than 30 of monthly gross income.

As a result that boost.

If the mortgage company requires the total debt not exceed 40 percent of the borrower s income then the borrower s total amount debt payments required including the house payment house taxes and insurance.

Social security recipients will use the initial award letter they received when they applied for benefits.

If a borrower receives 2 000 of social security disability then the mortgage lender will qualify the loan based on 2 500 of income.

This is usually a paycheck from a job or a w 2 form for income tax purposes.

/PREAPPROVEDMORTGAGEJPEG-e4fb5ba8d0164c7699b4b376a1492293.jpg)

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)